2.1.3 Financial Assistance

SCOPE OF THIS CHAPTER

This Chapter outlines the provision of financial assistance including Section 17 payments and exceptional payments for children in care.

AMENDMENT

This chapter was updated in June 2024 to provide details of AA Global, which is our new corporate service, for all translation and interpretation needs. Please refer to Section, 3.8, Interpreter and Translation Costs for further information.1. Provision of Financial Assistance

Financial assistance in terms of goods or services, or in exceptional circumstances cash, can be provided to a child, parent or carer under Section 17(6) and Section 18, Children Act 1989 to address identified needs to safeguard and promote a child's welfare where there is no other legitimate source of financial assistance.

In order to appropriately and efficiently apply these responsibilities, this guidance outlines the Local Authorities expectations regarding practice and requires all staff who may request financial support from the allocated budget, to be fully aware of these expectations and be able to justify any application for resources accordingly.

The management of the budget and compliance, as well as the Local Authority financial regulations, within which this guidance operates, rests with the budget holder.2. Criteria for Financial Assistance

The Core Criteria for all types of financial assistance are:

- The payment must be to safeguard and promote the welfare of the child;

- An allocated worker should be actively involved with the family at least for the duration of the payments and if the financial assistance is more than one off emergency assistance, this must be assessed as part of an assessment or through the review of a child's plan;

- All alternatives should be explored with the family to assist in accessing and utilising their existing resources to the best effect and support the family in becoming self-sustaining, prior to any application for funding;

- Payments should be made directly to the supplier or provider of services. Monies should not be given directly to the family or carers except in exceptional circumstances;

- At point of request for financial support it should be confirmed that there are no alternate sources of finance from the Benefits Agency, Housing Benefit, family or friend contributions, other agencies, charities. If theft is alleged, a crime number should be provided;

- All financial assistance must be time-limited and subject to review, at a maximum of 12 weeks initially for child care costs and a maximum of 6 weeks for all other assistance. The period for which funding has been agreed must be clearly communicated by the team worker to the person in receipt of the assistance.

3. Types of Financial Assistance

3.1 Subsistence Crisis (one off payments)

These should be exceptional and used to overcome a crisis, following the best assessment that can be achieved in the following circumstances:

Specific Guidance – Allowable expenditure

- Food per child per day £5 maximum, method of payment goods only, in exceptional circumstances cash;

- Gas £10 maximum one off payment, method of payment direct payment only, in exceptional circumstances cash;

- Electricity £10 maximum one off payment, method of payment direct payment only, in exceptional circumstances cash;

- Clothing maximum of £50 for each child one off payment, method of payment goods only, in no circumstances cash;

- Toiletries £5 maximum per child one off payment, method of payment goods only, in exceptional circumstances cash.

3.2 Clothing and Equipment

The provision of clothing, furniture, bedding or safety equipment can only be provided where an assessment determines items identified as essential to meet the needs of the child and/or prevent the child suffering Significant Harm and/or the need for the child to be looked after by the local authority.

Specific Guidance

- The assessment should address where needs are identified what avenues the family have taken to address the issue themselves, including family members support, via benefits and how family resources are being utilised;

- Where the family are unable to access support. Access to community resources should be considered. Liaison with the benefits agency, known charitable organisations locally that can be accessed and specific grants should be sought. For example, uniform provision can be accessed through schools and the Dedicated School Grant. Or checking with the Children's Centre for local arrangements and opportunities to access appropriate safety equipment;

- Submission for funding should include efforts undertaken to seek alternate sources of funding.

3.3 Travelling Expenses

This provision is available to support the transport of children, parents, carers or extended family member to attend assessments, activities, appointments and support groups which are essential to a child's plan or to comply with court direction.

An assessment must ensure and agree that they could not reasonably be expected to travel using their own means due to medical, situational, financial or geographical reasons. This support is to be provided through bus tickets, train tickets or reimbursement of own, family or friend's petrol costs.

Taxis are not the first option to be explored and will not be approved unless all other avenues of travel have been exhausted and the cost of travel has been evaluated against the benefits to the child of the appointment.

Specific Guidance

- GP confirmation of medical conditions reported to impact upon capacity to travel or use public transport are to be provided to the Local Authority by the parent, carer, adult family member;

- Expenses for parents/relatives to attend contact with children looked after by the Local Authority must come out of LAC code;

- Reimbursement of petrol costs to be subject to driver and vehicle being appropriately licensed and insured. The rates of payment for fuel, has to be based upon average miles per gallon for the vehicle used for an agreed distance between home to meeting, the cost identified to be agreed prior to submission for approval. For guidance on the reimbursement rates for petrol costs, please refer to HM Revenues and Customs Guidance;

- Only council approved Taxi companies can be used for transportation.

3.4 Child Care Costs

This includes financial assistance for day nursery, child minder, after school clubs and play scheme provision. This provision must be part of a Child In Need or Protection Plan where it is essential to safeguard the child's welfare and prevent the need for the child to be looked after by the Local Authority.

In providing assistance for Child Care there is a responsibility to ensure the service provided is appropriate and of sufficient quality to ensure the provision is of value to the child and provides a safe environment.

Specific Guidance

- In every case where applicable free child care resources should be used. The Birth to Five Service should be contacted in terms of whether the child is entitled to free entitlement and to determine a suitable nursery school/class or provider that will meet the child's needs;

- Where free child care cannot be accessed or the use of child care is required for a short time or for a specific event, consideration should be given as to whether the needs identified meet the criteria of supported child care budget, accessed via application through the local Children's Centre processes;

- Child care provision must be to meet the needs of the child, not the parent/carer. As such any child care provision to be sourced must have an Ofsted rating of 'Good' or above and be registered. Local availability can be sourced through the Locality Coordinator from the Birth to Five service; for child minding, via the NCMA vacancy coordinator. Any queries, advice and support regarding the identification of such resources can be accessed through the managers of the local Children's Centre;

- Child care provision to be agreed for a maximum of 12 weeks initially and for subsequent periods of up to 6 weeks thereafter. A Child in Need Review (see the Child and Family Progress Plans and Meetings Procedure) to be held before each further period of child care is provided.

3.5 Accommodation of Homeless Young People aged 16 and 17

Specific Guidance

- If a young person has been assessed as section 17 the financial assistance including accommodation costs should be coded to section 17 budget. If the young person has been made looked after, the financial costs should be coded to the LAC budget until the case moves to leaving care after 13 weeks;

- The addressing of homelessness of young people between 16 and 18 years of age is subject to the Lincolnshire Youth Homelessness Joint Working Protocol. Financial provision will only be provided in compliance with the application of this protocol.

3.6 Legal Fees

There may be occasions when contributions to applications and/or legal representation is necessary. This action is to be used rarely and in line with policy and procedures with regard to Kinship Care Procedure.

Specific Guidance

- Agreement must be reached that any instructed legal representative that the Local Authority makes contributions to, will charge at the basic Legal Aid rate.

The maximum funding is £1500 and should be coded to section 17.

3.7 Specialists Assessments and DNA/Hair Strand Testing

If special assessments or testing is required prior to care proceedings to ascertain if a child is at risk of harm then these need to be agreed by support panel.

Specific Guidance

- Costs should be coded to Section 17;

- Any agreement for the above needs to be via a support panel application or in an emergency by Head of Service.

3.8 Interpreter and Translation Costs

Where English is not the first language for children and carers, workers need to ascertain if the child and/or carer is able to understand and speak English to the level that they can complete their intervention in a meaningful way.

If the child and/or carer is not able to understand or speak English to the required level then an interpreter will be required. Consideration is to be given to whether this could be an extended family member or family friend or community worker including teaching staff with the carers permission if it will not be detrimental to the intervention.

If a professional interpreter is required, AA Global Translation and Interpretation should be used. AA Global is the corporate service for all translation and interpretation needs. Information and guides can be found on our SharePoint page (Interpretation and Translation Service) and the designated email address for queries is BS_TranslationService@lincolnshire.gov.uk.

Key documents such as assessments, child protection case conference minutes, plans and court documents should always be translated.

Specific Guidance

- Professional Interpreters should always be used for Case Conferences and Looked After Reviews if there is a need.

3.9 Other Types of Payments not Covered by this Guidance

- Payments for the care of children in care residing with Local Authority approved foster cares (including family and friends) see Information Pack for Financial Support Guidance for Social Workers and the Funding of Kinship Care Placements Procedure;

- Payments for those holding a Residence Order / Child Arrangements Order see Residence Order/Child Arrangements Order Allowances - Children's Financial Review Procedure;

- Payments to those holding a Special Guardianship Order (SGO) see Special Guardianship Orders Procedure;

- Payments to adopters see Adoption Support Procedure;

- Payments to those in receipt of Direct Payments (See Direct Payments Procedure).

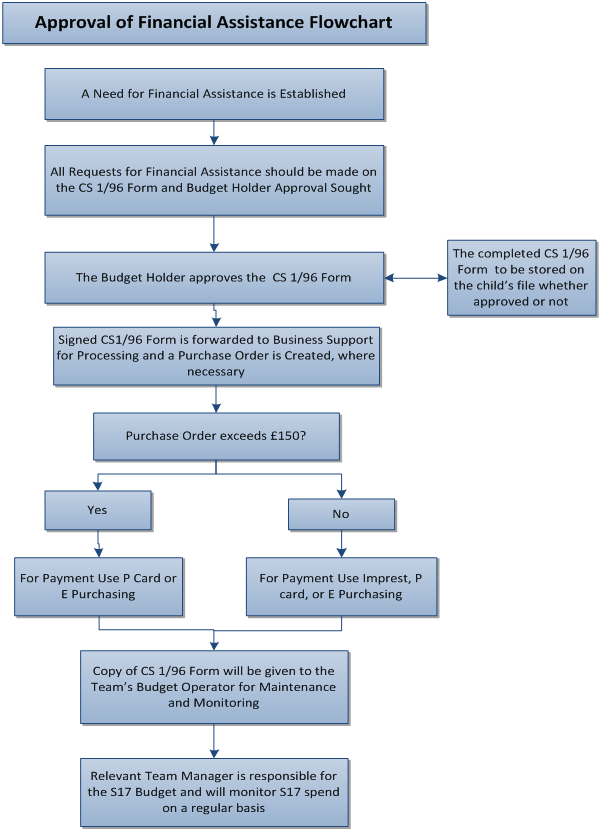

4. Approval of Financial Assistance

All requests for financial assistance should be made by the team worker on CS1/96 form with the supporting welfare issue that needs addressing and the alternatives that have been explored. Goods and services should be purchased through 'e purchasing' or 'purchase cards'; cash via 'imprest' should only be used in exceptional circumstances. Cumulative costs for each child over a financial year must also be taken into account when deciding the appropriate level of delegated authority and should also be available to support the discussion in context.

In all cases the child's worker will make their request to their supervising Practice Supervisor who will review work undertaken and will confirm approval for submission to the manager, or will identify additional actions that need to be undertaken.The schedule for authorisation applicable to this budget is as follows;

| Financial Approval Limits | Authorised to Sanction |

| £1 - £100 | Practice Supervisor |

| £100 - £5,000 | Team Manager |

| £5,000 and above | Head of Service |

It is expected that the usual practice will be that all proposed expenditure is submitted for approval and agreement through the delegated power. Where the budget holding Team Manager is unavailable, delegation can be given to the Practice Supervisors for the approval of single items within the prescribed financial limits. This should be reported to the budget holding Team Manager upon return.

Where the budget holding Team Manager is absent any financial assistance or a single item above approved limits, will require approval from a Team Manager from the same management group, with an automatic notification to the budget holding Team Manager for their return.

The completed CS1/96 form should be stored on the child's case file, whether approved or not, with the nature of the request and outcome being recorded in case notes by the worker.

Where ongoing services have been identified as a need and require approval, for the provision of services over a period of time. A 'Framework' CS1/96 Form should be completed, with the weekly amount listed, the time this weekly payment should be made from to the end or review date. The total commitment should also be listed to ensure budget commitments are correctly monitored.

A copy of any CS1/96 form completed and approved will also be given to the Teams budget operator for the maintenance of financial management of the budget.

4.1 Monitoring Spend

It is the responsibility of the Team Manager to come in on target for the S17 budget and monitor spend on a regular basis.

Appendix 1: Approval of Financial Assistance Flowchart